#32 My Experience Investment Plan

Share

Lately, I’ve been feeling — with all my senses — how every choice I make leads to a completely different experience. The more fun my days become, the more I feel a subtle pressure: how should I spend my time, and what should I choose?

Earlier this year, on my birthday, a friend gifted me a candle she made by hand. On it was written: “Your 26 will be legendary.” And it really has been — my 26 has been nothing short of perfect.

Last year was a whirlwind of small and large challenges. I spent much of it trying to center myself. But now, after going through that, something just feels right. I went around saying, “I have a good feeling about this year,” insisting on my happiness with no particular reason. Surprisingly, that groundless confidence worked. I’ve felt more composed and happier than ever — a calm conviction that I’m on the right path. But still, the question lingers: What does it mean to keep going on this path? How do I grow — how do I "strive forward"?

*Strive (정진): A Buddhist term meaning to make continuous effort toward enlightenment without laziness.

Ironically, the moment I start thinking about how to strive, I stop feeling relaxed. After all, striving requires a goal — and setting a goal takes a surprising amount of energy. Amid these questions, I found clarity in a book called [Die with Zero] by Bill Perkins.

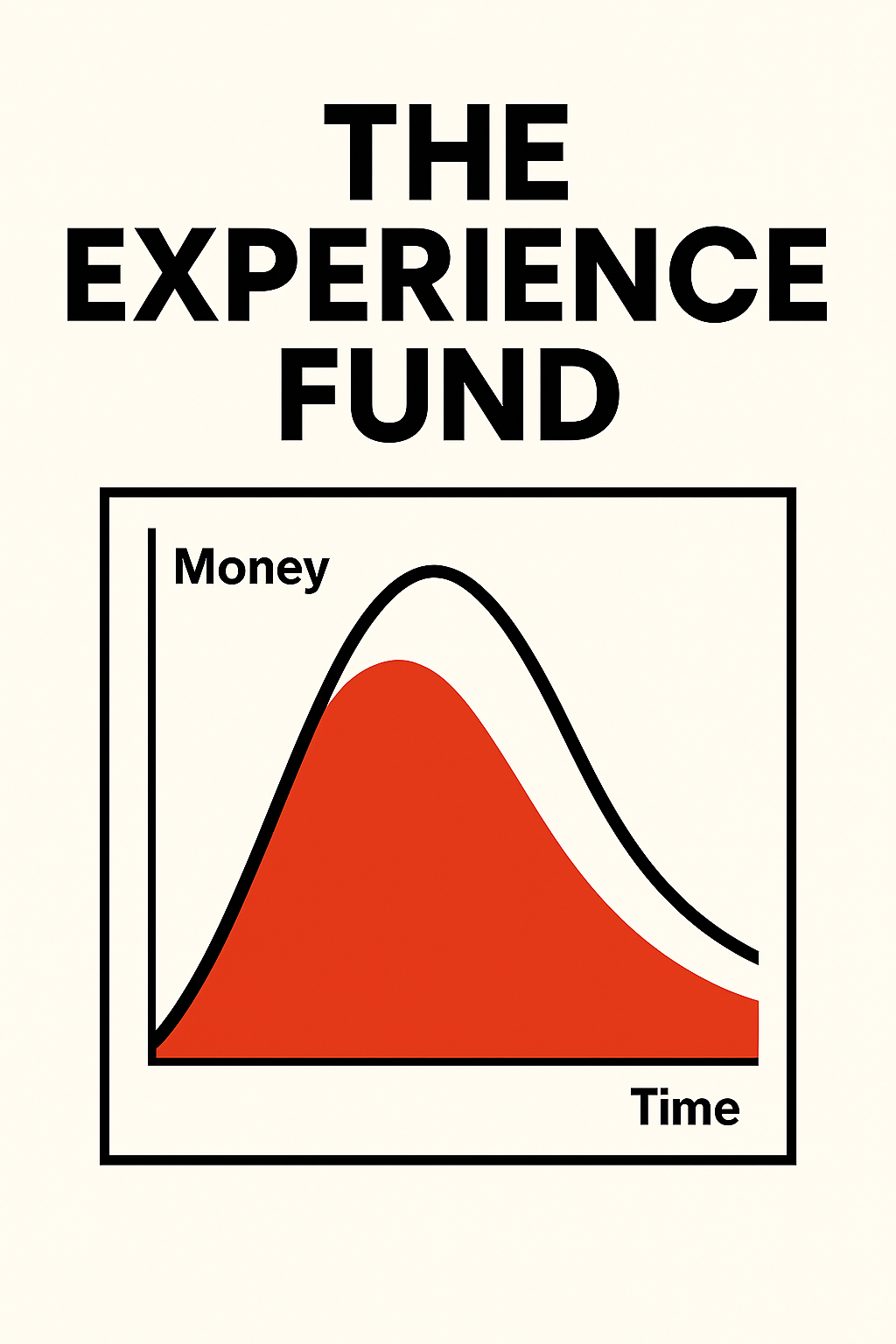

The book explores how we can use our money and life’s time more meaningfully — how we can optimize our life energy. It boils down to four key ideas:

1. The goal of life is to maximize experiences.

The aim isn’t to earn more money, but to spend money in ways that build meaningful experiences. If you die with money left in your bank account, you’ve lost life energy — a missed opportunity to live.

2. Every experience has its right timing.

Perkins frames life around three key resources: time, money, and health.

In youth, we have health but no money. In middle age, we have money but no time. In old age, we have time and money, but not health. So the real art is choosing experiences that give the highest return at the intersection of those three. Maybe that’s why we all dream of being “young and rich” — to have all three at once.

3. Invest in experiences — they pay memory dividends.

The book introduces a concept called the “Memory Dividend.”

A backpacking trip in your 20s isn’t just an expense — it’s an investment that keeps paying emotional returns for the rest of your life. I still carry the imprints of those moments: my first trip to Croatia, a quick getaway to Paris while working full-time, my internship stint in the US. If my first Europe trip had been to Iceland, maybe today I’d be dreaming of a winter honeymoon there instead.

Some memories, I revisit again and again. Even if the moment was brief, the emotional interest compounds over time. When I meet my college friends, we always end up reminiscing about that dramatic spring. That family trip in middle school? Still a hot topic at every family dinner. My emotional assets have definitely grown through memory dividends.

4. Money is the fuel of life.

It’s not about maximizing assets, but optimizing them to create joy.

When, where, and how you spend matters more than how much you save.

Of course, we need to save — but we should also think about what we’re saving for.

Think of it like this: “If it brought you deep satisfaction, it was basically free.”

(Kind of like “If you eat it happily, it has zero calories.”)

Unlike the vague romance we often wrap around life choices, this book offers a more mathematical approach to time and money. It backs up the idea of a romantic life with clear logic. (But no, it’s not just about YOLO.)

So when is the right time for a certain experience? To answer that, ironically, you need experiences. You need to assess your own experience portfolio:

Which investments are paying dividends now?

Which ones gave the highest returns?

Which turned into emotional junk bonds?

Timing matters in both investing and life.

There’s no such thing as a perfect timing — even the most famous investors can’t buy at the exact peak.

So I came up with my own “experience investment plan” without feeling pressured to time it perfectly.

-

Now is the golden season. Play hard, work hard = invest boldly.

-

Avoid instant highs that crash fast. = Stay away from leverage and future trading.

-

But don’t fear risk entirely. = Maybe a little crypto-level risk is okay.

-

Invest steadily in good people and time with them. = Like buying the S&P 500 regularly.

-

Don’t agonize over perfect choices. =There’s no perfect investment timing.

-

If a past choice was regrettable, define the lesson. = Figure out why it flopped.

-

Save up experience capital — time, money, energy — for better future choices. = Can’t invest well if your accounts are empty.

With this mindset, I’ve become more intentional with my time. I’m avoiding cheap thrills and meaningless hours. Even if I sleep the entire weekend away, I make it real rest. When I find myself trapped in the shorts/reels abyss, I physically get up and go to yoga.

In Singapore, the days are getting longer. The city feels more alive.

To make the most of that, I’m visiting a new hip place at least once a week.

There are so many beautifully curated spaces popping up — spaces that seem made for joy, not just profit. After I explore more, I might write a piece about them. These days, walking through those spaces with people I love is my favorite kind of joy.

When you look at choices through the lens of investment, you realize:

Too aggressive, and you can’t sleep at night.

Too reactive, and you mess up the plan.

Too passive, and opportunities vanish before your eyes.

But take the long view — not this quarter, but two years out — and the picture changes.

Even if you’re in a rough patch, accumulated little wins and hope for the future can add up to something much greater. The real value of investment, after all, is belief in what’s to come.

I was feeling overwhelmed about what came after happiness — how to prepare for more. But as a beginner investor, I realized: rather than worrying about losing what I have, I should focus on growing it. Now that I’ve cultivated the perfect experience investment mindset, all that’s left is to enjoy the journey.

And today? Another memory dividend, deposited.